5 Minutes to Retirement Premium Videos

Get ALL 25 Premium Videos below for a one time membership fee of $149.99

What to look for in a retirement advisor

Have you ever heard you will never get to where you are going if you don’t know where you are going? If not, you have now! If you don’t know what type of retirement planning advisor to look for during your retirement years then chances are you will never find that...

3 Simple Strategies To Consider When Investing Your Retirement Money

Welcome to simple again! While many retirement planning advisors confuse people with their fancy talk and sales pitches this video will keep money as simple as it gets. You will learn three simple ways to invest your retirement dollars. After watching this video...

Yes, You Can Have It All

Some people will say, “You can’t have it all”. Well, in this video you will learn you can come pretty close to having it all during your retirement years. This video will show you a concept of how a certain idea can give you several different options for your money...

Why People Lose Money In The Markets

In this video you will learn about the emotional side of investing and why the average investor normally underperforms when investing their money in the stock markets. Your retirement income planning years need to be years that are based on fundamentals not emotional...

When Should I Start Taking My Social Security Benefits

This video will discuss some of the basics of Social Security benefits and should help you have a better understanding of when you should take your benefit. Again, there is not a one size fits all solution here and the value you of a good retirement planning income...

When Did You Say I Would Get My Money Back

This is one of the most important questions you need to ask an advisor while you are entering or already in your retirement planning years. Anyone can talk about how much money they can make you during your retirement years. But what if you retire in the wrong year...

When Am I Required To Withdrawal Money From My IRA

You have to know this or you could face a 50% penalty. The IRS requires you take what is called a Required Minimum Distribution (RMD) from your IRA or other qualified retirement accounts. Make sure you ask your retirement planning advisor about this.

What Investments Can I Put Into My IRA

Once again simple wins in this video. You have an IRA or 401k, so what now? Where can you invest that money during your retirement planning years. This video gives you simple, easy to understand options for your retirement money. Remember, simple helps you...

Todays Reality What Is vs What If

This video will help you be a “What is” person during your retirement planning years instead of a “What if” person. “What if” may never become reality so I always tell people let’s deal with “What is”. This concept will help you throw the clutter, slogans and sales...

The Power Of Zero

Zero seems like such a small number, does it not? If you told a friend you made 0% on your investment, your friend would not be very impressed. Unless, that is, the alternative was losing money on your investment. Sometime zero can be your best friend during your...

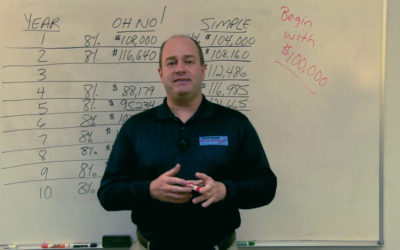

One Bad Year

That’s all it may take to mess up your retirement planning years. One bad year. In this video I will show you a very simple illustration on how one bad year can create chaos during your retirement years. When you meet with a retirement planning advisor make sure...

How To Make A Monthly Budget During Your Retirement Years

Before you create a retirement income plan for your retirement years you first must know how much monthly income you need during your retirement years. This is one of the first and most critical steps to your retirement income planning.

How Much Money Do I Need Liquid For Emergencies

Emergencies. We all have them but don’t know when they are going to happen. That is why they are called emergencies. Truth be known, most of the time when it rains on us it pours. That is why I always say leave more money in your emergency fund than you think you...

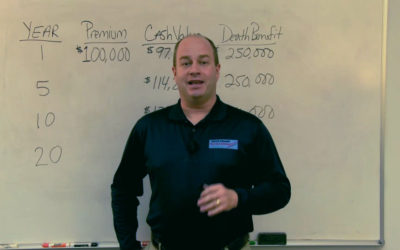

Do I Need Life Insurance During My Retirement Years

There is not a one size fits all answer to this topic for your retirement planning years. I will say this, I have never taken a widow a check that they offered to give back to me. Planning for the ones left behind when you pass away should be a big part of your...

Dare To Be Different

Be different in a good way and enjoy your retirement planning years. This video will encourage you to discuss your retirement planning needs with multiple advisors, seek out many options and opportunities then choose the one that fits your situation the best. May you...

CD Alternative

Past generations seemed to enjoy much higher interest rates on their investments such as a CD or savings accounts. But the “What is” is rates today are not nearly as high as they were in the past. This video will share with you some alternative ideas to low interest...

Beware Don’t Let The Propaganda Fool You

There aren’t many companies that market their product as well as financial companies. During your retirement planning years you DO NOT want to be fooled by creative marketing or propaganda. In this video I will show you in a simple and easy to understand way how...

Changing Your Thinking For Retirement

You are no longer going to be working. The wages will be stopping but the retirement income is just starting. You need a retirement income advisor that understands that you have changed places in your life – you are now in the retirement income stage of your life...

How Do I Allocate My Money In My Retirement Years

If you like things simple you will love this video. When things are simply you tend to understand them a little better. When you understand things better you can make better decisions. During your retirement planning years you have to make the best decisions...

What-Happens-If-I-Lose-Money-In-My-Retirement-Assets.mp4

Now this is a question anyone entering or already in their retirement years needs to ask their retirement advisor. Any advisor can talk about how much money you could make when the stock markets go up. What you need to know is what happens to your retirement money...

Challenges I face in retirement

There are several financial challenges you may encounter during your retirement years. This video discusses some of the challenges you may face and the important of working with a retirement income advisor that can help you navigate through your retirement years. It...

The Difference Between Safe Money And Risk Money

As you plan your retirement years you need to know the difference between risk money and safe money. Once you have an understanding of safe and risk money you will be able to make decisions for your retirement years that YOU are comfortable with. Do not let anyone...

Run As Fast As You Can From This Advisor

You need to know what type of retirement advisor you need for your retirement planning years. If you choose the right advisor your retirement years could be all you ever dreamed of. If you choose the wrong advisor your retirement years might be a disaster. In this...

Be On The Right Side Of Money

You will learn in this video interest works two ways. You either make interest on your money or you pay interest on your money. During your retirement years it is critical you are making the interest instead of paying the interest. Most of the time if you are on...

401k Rollover While You Work

What if you could start your retirement income planning process while you are still working? This video shows you, YOU CAN! If you are at least 59 ½ years old there is a good chance you can roll your 401k money into an IRA which could possibly give you more options...